Insurance customer service is as important as the level of cover

We work with distributors to plan the insurance customer service experience throughout the policy lifecycle.

Our proprietary platform, SPECS TM , enables us to tailor the insurance customer service for each individual distributor. We can do this for every aspect of the insurance product. It is this flexibility that drives our service delivery every day.

System events drive insurance customer service

Specialty Risks recruits and retains individuals who are focused on delivering the insurance customer service we have promised.

The reason our people can consistently deliver this level of service is the bespoke, event-driven workflow that is the heart of SPECS TM .

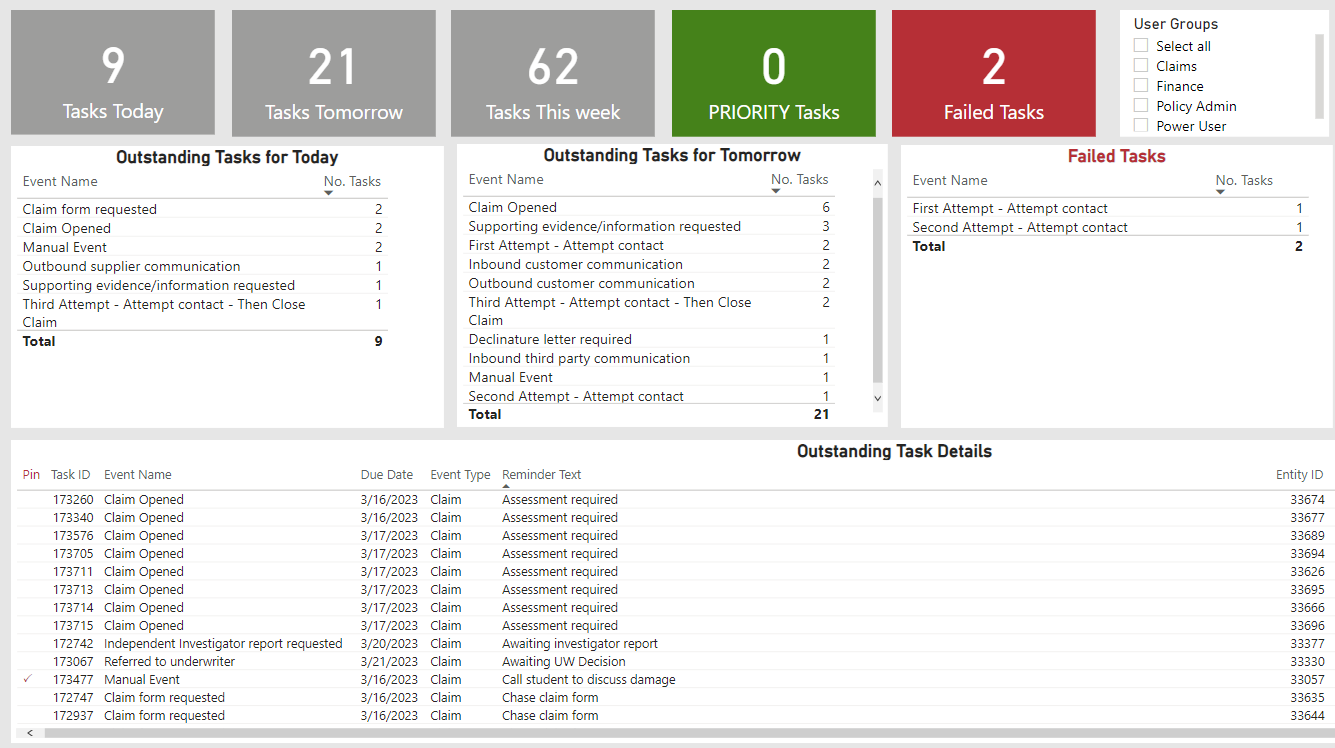

Using a personalised PowerBI dashboard, every member of the team has their own workflow showing the work they are required to do each day. This intelligent system prioritises work based upon pre-defined parameters.

Supervisors and managers have their power user dashboards to ensure that each member of the team delivers the insurance customer service every day.

Every single event performed on SPECS TM is recorded and measured against the pre-defined service standards. The performance against service standards is used to assess the effectiveness of both individual team members and the operational teams as a whole.

Communicating with policyholders

We work with organisations to define a communication plan with policyholders. These plans consist of a mixture of automated and human communications.

Automated communications

Specialty Risks has developed our Communicator TM Application to be the “brain” behind automated communications. The Communicator TM Application gives us the ultimate level of flexibility when choosing how and when to communicate with policyholders.

Our Communicator TM Application “listens” for signals across the SPECS TM platform and delivers timely and accurate messages to policyholders. The Communicator TM Application forms the basis of our machine-learning capability to enhance communications with policyholders.

The human touch

We understand that having the capability to switch between automated and human communications is critical to the success of an insurance scheme.

Poorly delivered automated communications lead to policyholders having a poor experience and then cancelling or not renewing their insurance. People who are not trained and empowered to resolve policyholders’ issues quickly and effectively can lead to poor customer service and lower retention levels. Every member of our team who speaks to customers is highly trained and is empowered to resolve issues as quickly as possible.

Make customer service the heart of your insurance

Contact us to find out more about how we can help you deliver the best customer service for policyholders